The restaurant industry is anything but low cost. Labor. Payroll. Food purchasing. Another important cost: credit card processing. In order for restaurants to take credit card transactions, they have to sign up with a merchant services provider to perform transactions between a customer, their bank, and your bank. Credit card processors perform this service by charging a percentage per transaction passed onto the merchant.

A new method has popped up to help cover the costs of credit card processing. This method goes by a few different titles: surcharging. Non-cash transaction fee. Ultimately, it is a way for restaurants to pass on the cost of a credit card transaction onto their customers to help pay for the cost of processing. This is a growing trend among restaurants.

Are you asking yourself: Is surcharging a good or bad thing for the restaurant industry, let alone my business? Ed Black of Heartland Payments, the preferred processor of Heartland Restaurant, has insights that can help drive you towards the right decision.

What is surcharging?

Ed: Surcharging is the practice of passing a fee back to the consumer for the use of credit card payment.

Would surcharging help my business?

Ed: It’s a simple question with a complicated answer. Yes, it can certainly offset costs assumed by business owners for accepting electronic payments. However, it is a controversial practice, and many consumers don’t like having fees passed back to them for using their preferred form of payment. This could potentially harm business owners.

How can I best position this to my customers?

Ed: It is imperative that the business owner set the proper expectations right from the outset. Clear signage and communication is a MUST, so that a customer knows, before purchasing goods or services, that a fee may be added to a credit card purchase. This give the consumer the option to make a choice of how payment will be made, and help eliminate confusion and upset customers.

Can Heartland Payments help me set-up surcharging?

Ed: Surcharging is a highly regulated practice, and the card brands have very specific requirements of merchants who wish to surcharge. For example, debit cards, whether PIN or Signature, are NOT to be surcharged per card brand requirements. However, many businesses are doing so and could face stiff consequences. Sadly, it’s likely because the processor set them up incorrectly or misinformed them.

Heartland is the ONLY surcharging program endorsed by all major card brands. We can help any merchant wishing to surcharge get set up properly. Moreover, our technology can identify credit and debit cards within an instant. This ensures that only credit cards will be assessed the additional fee, while debit cards and gift cards are exempted. Heartland will provide the proper signage and communication for the business owner to share with customers, providing them the opportunity to make educated decisions about payment. Finally, Heartland makes it easy for a business owner to revert back to a traditional form of processing if surcharging is not the right fit for their business.

The Math Behind Surcharging

What’s the math behind surcharging? Let’s take a look.

First, let’s determine your overall credit card processing rate and how much it costs you per year. Assume that you are a fast food restaurant that brings in $1,000,000.00 in revenue. 80% of your transactions are card transactions. You have an overall effective processing rate of 3.5%.

$100,000,000.00 X.8 = $800,000.00 X.035 = $28,000.00 per year annual effective processing cost without any additional processing or merchant services fees.

According to Statista.com, 18% of fast food restaurant transactions are credit cards, or roughly 30% of total card transactions. Let’s take that into account regarding the total processing cost.

$28,000.00 X .3 = $8,400.00 total in credit card processing fees.

Implementing a credit card surcharge can help recover this overall cost. Implementing 3.5% can help cover the total cost of credit card processing fees by passing that back onto the customer. That’s $8,400.00 per year or $42,000.00 over a 5 year period. $8,400.00 can be enough to purchase new equipment, finish renovations, boost your marketing, or purchase a new POS system (like Heartland Restaurant!).

What Steps Do You Need to Take?

There are several steps to take before implementing surcharging. Not following these steps could put you in a bad position between you, your customer, and even the law. Here are important surcharging insights from Visa:

Customers must be provided with clear signage in the restaurant indicating the implementation of a surcharge fee 30 days before implementation.

Surcharging can ONLY be performed on CREDIT cards. No debit card can be surcharged.

Customers MUST be notified of surcharge at point-of-sale, both in-store and online, and on every receipt.

Merchants can surcharge on credit card purchases so long that it does not exceed the merchant discount rate for the applicable credit card surcharged.

Can I implement surcharging with Heartland Restaurant?

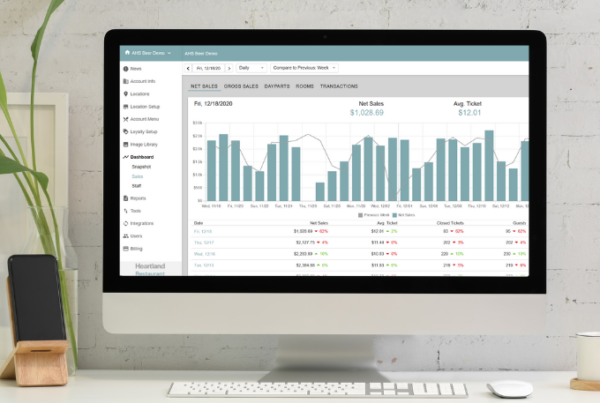

Of course! Your local Heartland Restaurant dealer, Advanced Hospitality, can help set-up surcharging for your restaurant in under an hour. Heartland Restaurant is a dynamic POS system with true ROI potential. From walk-in to checkout, get the best with online ordering, no-contact payments, and low processing rates – all for an affordable, monthly rate. Contact us today to learn more.

Click here to connect with Ed Black and find out more about how Heartland Payments can help your business.